International Economy 2022 | VTZ Outlook

As she did last year, Susana Muñoz presented the outlook for the international economy 2022 and its effects on Mexico. The content of this summary builds on what was discussed during our international trade webinar, Trade Table 2022, and it is complemented by what has happened since then.

Our «Trade Table 2022» had the special participation of Jorge Miranda, international advisor of Cassidy Levy Kent, as well as our partners Adrian Vazquez, Susana Muñoz, in charge of the Chinese Desk of VTZ, and Emilio Arteaga.

Asia and the International Economy 2022

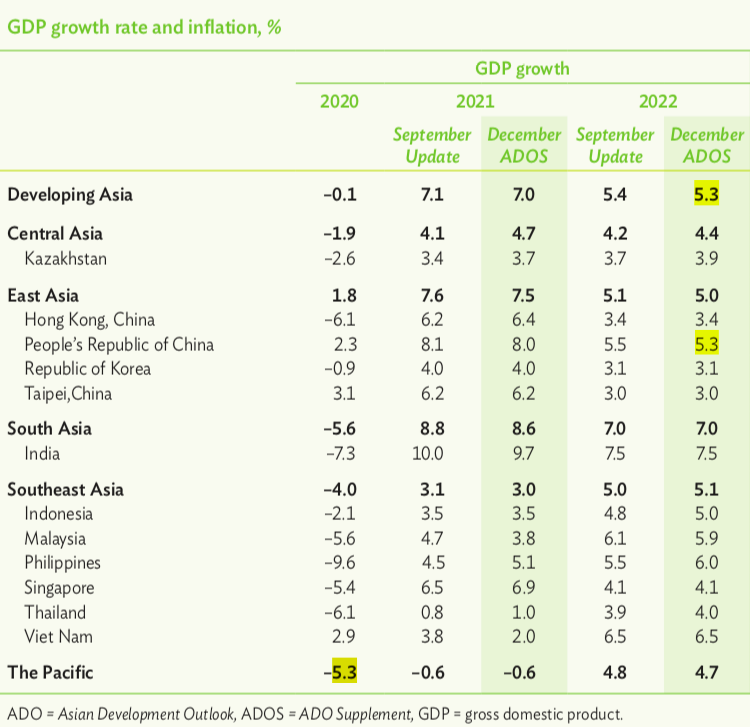

Recently, the economic report by the Asian Development Bank mentioned that Asian economies would be among the few in the world to report economic growth. The estimates establish a regional growth of 7% and 5.3% by 2022.

However, two countries stand out for the highest economic growth in 2021: China and India with growth forecasts of 8% and 9.7%, respectively. Similarly, economists expect significant growth for Vietnam in 2022, as can be seen in the following image.

Economic difficulties for Southeast Asia in 2022.

The Asian economies (Vietnam, Thailand and Singapore) have been characterized by a covid-zero policy, which leads countries to resort to restrictions such as confinements, massive testing and partial closures of industry and trade. These policies will undoubtedly continue to affect production and supply for value chains in Southeast Asia.

It is worth remembering that China has the objective of maintaining a «blue sky» for the Winter Olympics. In that sense, China established heavy restrictions in approximately 64 cities, as well as ordered major industrial closures in approximately 5 provinces. As a result, we will continue to experience problems in the production and supply chains.

China’s urea plants are getting caught up in Beijing’s drive to ensure blue skies for the Winter Olympics, which includes ordering factory shutdowns to curb air pollution https://t.co/nu0aNuhE4E

— Bloomberg (@business) January 11, 2022

The effects of the RCEP on Mexico.

The recent entry into force of the Regional Comprehensive Economic Partnership (RCEP), derived from the 2015 ASEAN agreement, the largest free trade agreement in the world, will boost the economic integration of member countries by facilitating intra-regional trade and investment and offering alternatives to China’s rising manufacturing costs.

In addition to trade, the RCEP allows investments from its members with preferential treatment. In this sense, businessmen with manufacturing operations in China will take advantage of the entry into force of the RCEP to implement the «China plus one» strategy, improving production costs by relocating their operations to the Southeast Asian countries that are members of the agreement.

In recent years, Mexico has not been very «aggressive» in its efforts to attract Asian investment. Now, Mexico will have to compete with the RCEP countries and try to position itself as a more attractive country so that investments do not go to other Asian RCEP countries. The economic context makes it difficult for Mexico to compete with the favorable investment and trade conditions offered by the RCEP. For this reason, companies with manufacturing operations in China will probably seek to enter the markets of other Asian countries, such as Vietnam, Malaysia and Thailand.

Mexico's Role in the U.S.-China Conflict.

Mexico should play a central role in the conflict between China and the United States. However, the Mexican government has given conflicting and contradictory messages. On the one hand, Mexico seeks to attract Chinese investment and, in turn, U.S. investment, and some Chinese sectors and investments conflict with the Biden administration’s policy of relocating strategic supply chains. At the same time, policy changes in the energy sector are increasing trade tensions with the United States.

On the other hand, President Andrés Manuel López Obrador has already stated on two occasions that China represents a threat to North America and that it is necessary to strengthen the region to curb the Asian country’s economic growth, which has provoked a response from the Chinese Embassy in our country.

For more information on AMLO’s statement regarding the economic bloc against China, please see our next news item:

Decree exempting the payment of import duties.

Decree exempting the payment of import duties. Today, the «Decree exempting the payment of import duties on the goods indicated«, issued by President Andrés Manuel

Undoubtedly, Mexico lacks a clear policy to attract investment from China, beyond a platform called investing in Mexico. In our opinion, this will affect the attraction of investment in the coming years and its integration with other economies.

Increase in Mexico's exports to the United States.

In our analysis for the 2022 international economy, we believe there are two important factors to consider with respect to increasing Mexico’s exports to the United States in 2021. The first factor is the effects of the U.S.-China trade war. Several international organizations, such as the WTO and UNCTAD, presented studies on the effects of the U.S.-China trade war, noting that imports from Mexico, Taiwan and Korea replaced imports from China in the U.S. For more information, see our bulletin: «UNCTAD Analyzes the U.S.-China Trade War».

COVID

As a second factor, we recall that Mexico has been one of the main trading partners of the US in the last decades. However, the economic revival in the «post-lockdown» period due to the COVID pandemic led to an increase in exports to the U.S., placing Mexico as the main trading partner of the U.S. today.

As is well known, Mexico is currently the main trading partner of the U.S. However, VTZ points out that Mexico did not make a big jump in real terms.

Changes in the International Economy 2022 | Mexico's Trade Negotiations.

2022 is shaping up to be a year with a full trade agenda for Mexico. In recent days, the Undersecretary of Foreign Trade of the Ministry of Economy, Luz María de la Mora, announced that Mexico will not only have to evaluate its trade policy in the WTO and take over the presidency of the Pacific Alliance, but there are also plans for several trade negotiations.

Free trade agreement negotiations.

Need more information?

VTZ is a specialized firm in International Trade, with a team with extensive experience, contact us for more information.

Susana Muñoz

Local Partner | Hong Kong

Adrian Vázquez

Managing Partner | Mexico City

Emilio Arteaga

Local Partner | Mexico City