Entry into force of the CPTPP in Malaysia

On November 29, 2022, the «Agreement announcing the entry into force of the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) for Malaysia» was published in the Mexican Official Gazette of the Federation (DOF).

Implications for Malaysia

With Malaysia’s ratification of this Agreement, Malaysia becomes the ninth member of the CPTPP, alongside Australia, Canada, Japan, Mexico, New Zealand, Singapore, Vietnam, and Peru.

The CPTPP market comprises almost 500 million people and represents 13 percent of the world’s GDP. In this regard, the Malaysian government estimates that Malaysia’s trade will increase from US$481 billion to US$655 billion by 2030. In other words, Malaysia expects an increase of more than 30% in relation to its imports and exports after joining the CPTPP.

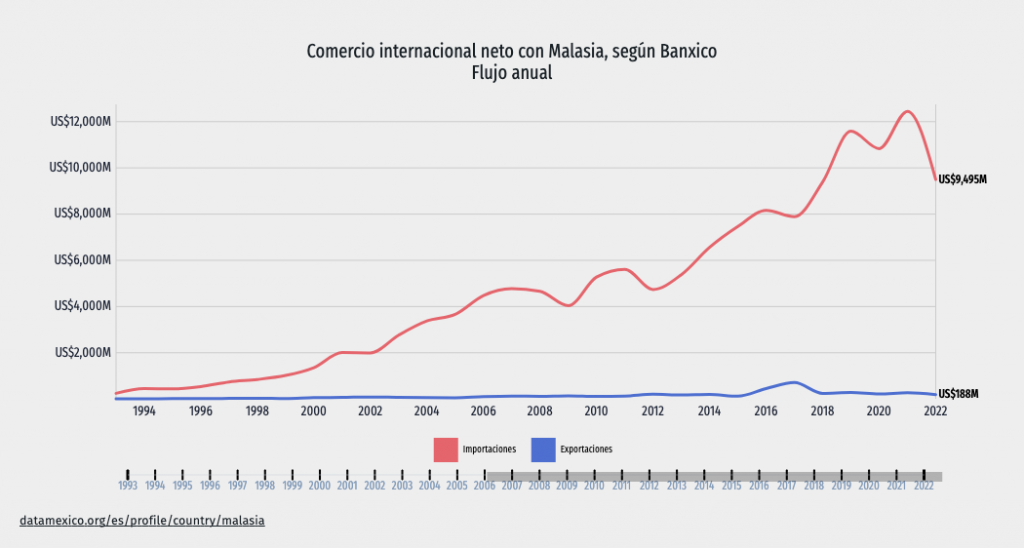

Mexico-Malaysia trade - importance for the electricity industry

According to Mexico’s Ministry of Economy, Malaysia’s cumulative investment to 2022 in Mexico represents US$732.1 million, equivalent to 0.1% of the foreign direct investment received in Mexico. Likewise, from January to June 2022, 48.1 million dollars of foreign direct investment from Malaysia was received.

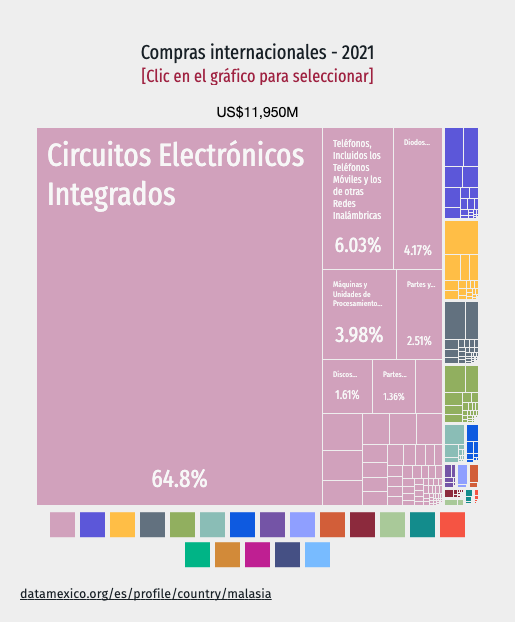

Among the main products imported from Malaysia during 2021, those of the electrical industry stand out, in particular: electronic microstructure circuits, electronic telephony devices, semiconductor devices, among others.

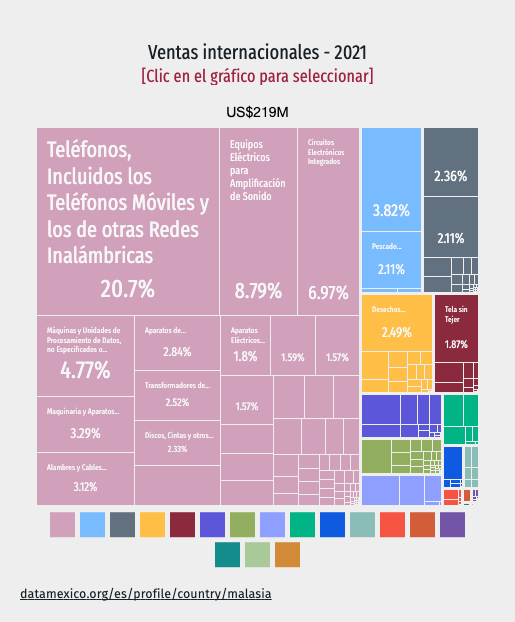

Likewise, the electronics industry stands out among the main products exported from Mexico to Malaysia in 2021, being: electronic telephony devices, microphones, and data processing machines, among others. Although Malaysia’s share in Mexico’s exports represents 0.05%, Malaysia’s entry into force of CPTPP may bring benefits to both countries.

Malaysia's certification scheme under CPTPP.

Derived from the agreement that announces the entry into force of the CPTPP in Malaysia, the Ministry of Economy also published the notice that announces the certification scheme that Malaysia will apply under the CPTPP.

The certification of origin that Malaysia will apply will be in accordance with Annex 3-A, paragraph 5, of the CPTPP. In other words, Malaysia opted for a certification mechanism in which the Malaysian competent authority will certify the origin of the goods. Therefore, a Mexican importer will not be able to claim preferential tariff treatment based on a certification of origin completed by a Malaysian exporter or producer, nor will the importer be able to certify the goods.

Applicable General Import Tax Rate

Likewise, the Ministry of Economy published an agreement that discloses the applicable rate of the general import tax for goods originating in the CPTPP region. In essence, such agreement modifies several articles to indicate that most of the imports of goods originating in Malaysia are exempt from import duties.

Unlike Vietnam and like Peru, the Ministry of Economy opted to include imports from Malaysia in the original members’ duty relief list that began in 2018. That is, imports from Malaysia will enjoy the same levels of tariff preferences as imports from Australia, Canada, Japan, New Zealand, and Singapore, for example, certain goods will enjoy certain tariff preferences and may be imported duty-free from January 2025 or 20230, as applicable.

Other countries

Of the 11 CPTPP’s signatories, only Brunei has yet to complete its ratification process. Also, the United Kingdom, China, Taiwan and Ecuador applied to join TIPAT in 2022, however, none have managed to conclude their accession process.

- https://www.eleconomista.com.mx/empresas/Malasia-se-convierte-en-el-noveno-pais-en-ratificar-el-TIPAT-20221007-0011.html

- https://www.swissinfo.ch/spa/malasia-tratado_malasia-ratifica-su-adhesión-al-tpp-11-para-elevar–competitividad–nacional/47955892

- https://www.eleconomista.com.mx/empresas/Congreso-de-Chile-ratifica-su-adhesion-al-Tratado-Integral-y-Progresista-de-Asociacion-Transpacifico-20221011-0117.html

- https://www.economia.gob.mx/files/gobmx/comercioexterior/fichas/mys.pdf

- https://datamexico.org/es/profile/country/malasia

Need more information?

VTZ is a firm specialized in International Trade and Customs with extensive experiences advising companies in export and import procedures, as well as complying with tariff and non-tariff restrictions to trade.