U.S. Subsidies on Electric Vehicles

Electric vehicles (EVs) are becoming an increasingly popular choice for environmentally conscious consumers. EVs produce zero emissions, making them a clean and sustainable mode of transportation. However, the high cost of EVs has been a barrier to their widespread adoption. To encourage its use and reduce emissions, governments around the world have implemented subsidies for their purchase. This post deals with the subsidy offered by the United States government to promote the purchase of EVs through its Inflation Reduction Act.

Objective of the Electric Vehicles Subsidies

Governments offer subsidies for electric vehicles to promote their adoption and reduce emissions. The primary goal of these subsidies is to make EVs more affordable and accessible to a broader range of consumers. There are numerous factors that determine the effectiveness of electric vehicle subsidies. Specifically, electric vehicles subsidies may be more effective if there is a whole strategy including tax exemptions, free public charging, reduced tolls, as well as investing in infrastructure.

Subsidies for electric vehicles can take many forms, such as tax credits, rebates, and grants. Tax credits are often used to reduce the cost of a new EV by a certain percentage. Meanwhile, rebates provide a direct cash payment to the consumer. According to the Inflation Reduction Act, the United States will offer a subsidy consisting of a refundable income tax credit for those who purchase electric vehicles that meet certain requirements.

What vehicles benefit from the subsidy?

Section 13403 of the Inflation Reduction Act states that eligible vehicles must have a battery with a capacity of not less than 15 kilowatt hours and be capable of being recharged by an external source of electricity. In addition, this subsidy is only applicable for vehicles with a suggested retail price of less than $80,000 USD for SUVs, or less than $55,000 USD for other automobiles.

How much money and time does the subsidy involve?

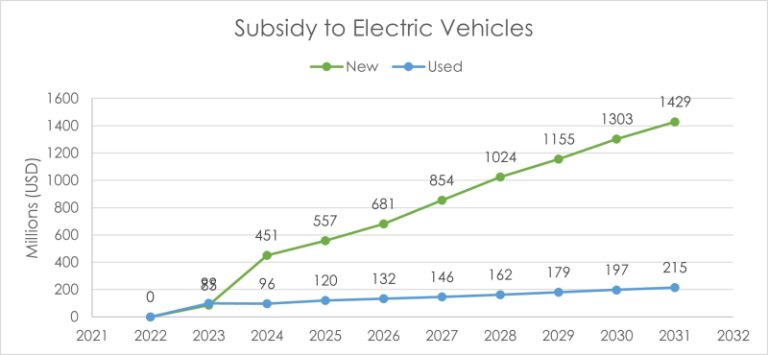

In terms of money, the refundable credit ranges from $3,750 to $7,500 USD. From 2022 to 2026, the United States has projected in its budget to spend a total amount of $7,451 million on new electric vehicle subsidies between 2022 and 2031. Likewise, the U.S. Government projects to invest a total of $1.347 billion on this subsidy for the purchase of used electric vehicles between 2022 and 2031.

One of the most significant factors in the effectiveness of electric vehicle subsidies is the amount and duration of the subsidy. A substantial subsidy is likely to be more effective in promoting EV adoption, as it can make a more significant difference in the cost of an EV. Furthermore, long-term subsidies provide consumers greater certainty and make them more likely to purchase an EV. However, a subsidy that is too high or lasts too long can lead to market distortions and create a dependency on government support.

How many electric vehicles will be purchased with the subsidy?

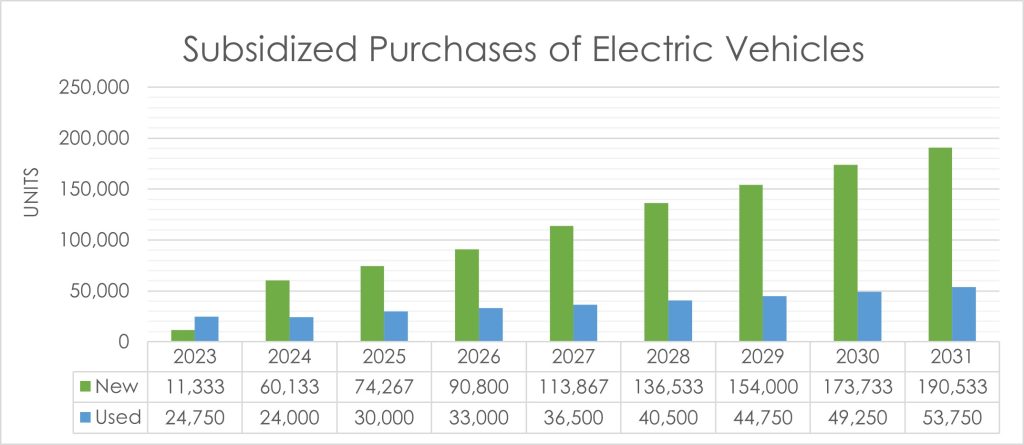

Certain projections indicate that only about 11,000 new electric vehicles and 25,000 used electric vehicles will be purchased using this subsidy in 2023. However, this number is estimated to rise to more than 190,000 new electric vehicles and 53,000 used electric vehicles by 2031. Following these projections, the number of new EVs to be purchased with this subsidy will increase more than 17 times from 2023 to 2031. In addition, the number of used electric vehicles to be purchased with this subsidy will be more than twice as high in 2031 as in 2023.

Does the subsidy exclude European and Asian electric vehicles?

The controversy surrounding the Inflation Reduction Act is that its subsidy requires that 40% of the raw materials from the vehicle batteries are sourced and processed in the United States or countries with which the United States has a Free Trade Agreement (FTA), such as Mexico and Canada.

Furthermore, Section 13401 of the law provides that vehicles eligible for the credit include those produced by authorized companies and excludes those manufactured by hostile foreign entities. As a result, vehicles with batteries produced in North America can access the benefits of the subsidy. But, those manufactured by other foreign companies are unable to do so (Washington Post).

Countries affected by the subsidy

Although the subsidy is intended to promote clean energy, its design discriminates against certain vehicle manufacturers based on the origin of their raw materials. Specifically, European and Asian manufacturers are prevented from accessing this subsidy because most of the raw materials they use come from China (Washington Post). In other words, they originate from a country that does not have an FTA with the United States. In addition, we must not forget that this subsidy is adopted amid the trade war between China and the United States.

NEW: Treasury Secretary Janet Yellen told @aduehren that Japan and the European Union would need to negotiate new trade agreements with the U.S. to meet the mineral-sourcing requirements in the IRA's overhauled electric-vehicle tax subsidy: https://t.co/g7oKH0ssb9

— Andrew Restuccia (@AndrewRestuccia) January 24, 2023

Thus, by its design, the measure only subsidizes the purchase of cars produced by companies using North American components. Consequently, electric vehicles produced in this region may be more financially attractive to consumers than those from elsewhere. As a result, the Inflation Reduction Act has strained U.S. trade relations with the European Union, Japan and Korea. In general, the central critic towards the Inflation Reduction Act is that it works in a way that helps U.S. companies to consolidate their position as the main suppliers of electric cars in the United States (Thomson Reuters).

Does the refundable credit amounts to a subsidy under the SCM Agreement?

Regarding the Agreement on Subsidies and Countervailing Measures (SCM Agreement), the Inflation Reduction Act is arguably a subsidy. In this regard, the SCM Agreement provides that a subsidy is composed of: 1) a financial contribution; 2) granted by a government; 3) conferring a benefit. In this case, the refundable credit granted for the purchase of electric vehicles is a financial contribution. This is because the credit causes the United States to forgo revenue that it would otherwise receive and, thus, constitutes a financial contribution under the SCM Agreement.

As noted, this refundable credit is established in the Inflation Reduction Act and, thus, it is created and implemented by the U.S. government. Hence, it is clear that the US government provides this financial contribution.

Finally, the refundable credit grants a benefit to the producers that they would not have in the absence of this contribution. If consumers lacked this support to buy electric vehicles, one may argue that it would not be as attractive or easy to purchase these electric vehicles in North America.

The electric vehicle subsidy provisions in the U.S. Inflation Reduction Act are discriminatory and suspected of violating WTO rules: Chinese Ministry of Commerce https://t.co/GmmXJ8Kegk pic.twitter.com/SVRGDWP9a4

— China Xinhua News (@XHNews) September 22, 2022

Therefore, the refundable credit granted by the United States for the purchase of electric vehicles falls within the definition of a subsidy under the SCM Agreement. The remaining issue is whether the subsidy is prohibited by the SCM Agreement. Specifically, by its design and application, whether this subsidy tends to substitute imported electric vehicles (from domestic electric vehicles or other origins like «North America») and reduce their U.S. market share. Thus, this subsidy could be contrary to the SCM Agreement.

What are the next steps of the dispute?

Currently, the European Union (EU) does not appear to have any intention of activating the WTO dispute settlement mechanism. In recent months, representatives of the United States and the EU have sought to ease the tension caused by the subsidy through dialogue. In December, they discussed the issue at their Trade and Technology Council meeting. EU representatives emphasized that they want the Inflation Reduction Act to stop excluding their companies. Moreover, they believe it would be unfeasible for the United States to achieve a true energy transition if the subsidy discriminates against European manufacturers.

Conclusions and insights

In conclusion, the Inflation Reduction Act’s electric vehicle subsidy is a long-term measure that represents a major government investment to promote an energy transition in this decade. However, this subsidy is source of controversy. Its design primarily benefits electric vehicles manufactured in North America and, thus, EVs from other origins may see an impact on their U.S. market share. It will certainly be important to follow the development of the discussions among the United States, Europe, and other Asian countries to know the outcome of this story.

Lastly, VTZ recalls that Mexico expressed its concerns with the original plan for this subsidy. In its initial version, the draft law stated that the refundable credit would only be available if the advanzed batteries originated from the United States, among other issues. As a result, the US made changes to iits law. The Inflation Reduction Act, as adopted, further strengthens Mexico as investment or nearshoring destination for the electric vehicles production that may benefit from the subsidies. Tesla’s decision to invest and build a new automotive plant in Monterrey, Nuevo Leon, was surely guided by this policy.

Need more information?

VTZ is a firm specialized in International Trade and Customs with extensive experiences advising companies in anti-subsidies and anti-dumping investigation procedures both in Mexico and the United States.