IMMEX

Con años de experiencia apoyando a la industria manufacturera, maquiladora y de servicio de exportación (IMMEX) en temas de comercio exterior y aduanas, VTZ asesora empresas, nacionales o extranjeras, que buscan operar y mantener su programa IMMEX y otras certificaciones como IVA e IEPS y Operador Económico Autorizado.

Industrias IMMEX con las que trabajamos

Abogados expertos en la industria IMMEX

Al tener una regulación especial, empresas en la industria IMMEX requieren servicios de comercio exterior, aduanas y fiscal altamente especializados. Liderados por Eduardo Zepeda, en VTZ tenemos un equipo de abogados, contadores y profesionales del comercio internacional dedicado exclusivamente a la Industria IMMEX, acompañando a empresas desde un punto de vista operativo (trámites y obtención de registros), así como los asesoramos en el cumplimiento de obligaciones.

¿Cómo le podemos ayudar?

Nuestro equipo de abogados y profesionales podrá apoyar a empresas, nacionales o extranjeras, en cualquier asunto relacionado con el programa IMMEX. Desde la obtención del registro IMMEX, ampliación del programa (mercancías sensibles), cumplimiento de obligaciones aduaneras-IMMEX (Anexo 24: control de inventarios, Anexo 31: Activo Fijo), auditorías preventivas, asesoría IMMEX-fiscal, entre otros aspectos. Nuestra asesoría está basada en identificar, prevenir, reducir y solucionar riesgos aduaneros y de este modo optimizar y capitalizar de la mejor manera sus operaciones comerciales.

Servicios Especializados Para La Industria IMMEX

- Obtención y cumplimiento del programa IMMEX

- Seguridad en la cadena de suministro y certificación OEA

- Inscripción en el padrón de importadores

- Efectos fiscales y certificación IVA/IEPS

Obtención y cumplimiento del programa IMMEX

Ayudamos a empresas que se dedican a la elaboración, transformación y reparación de productos, así como la prestación de servicios a la exportación, para que obtengan y, posteriormente, cumplan con el programa IMMEX. Para lo anterior, resultan necesarios una serie de programas, permisos y registros para cumplir con la legislación mexicana y ser una empresa competitiva en sus costos.

En VTZ contamos con una gran experiencia en el apoyo y asesoramiento a la industria maquiladora y manufacturera. Nuestro equipo analizará e identificará la estrategia adecuada para planear e implementar lo necesario para la obtención de los programas de fomento de la industria maquiladora y manufacturera. De igual manera, brindará la asesoría necesaria para mantener, ampliar o renovar el programa según sea el caso.

Seguridad en la cadena de suministro y certificación OEA

Nuestro equipo puede ayudarle a fortalecer la seguridad de la cadena de suministro de comercio exterior de tu empresa. Lo anterior, a través de la implementación de estándares mínimos en materia de seguridad internacionalmente conocidos, con la finalidad de obtener la certificación de Operador Económico Autorizado.

Nuestra asesoría consiste en el desarrollo y acompañamiento de estrategias para mejorar la seguridad de la cadena de suministro, con el objetivo de obtener la certificación y principalmente evitar la contaminación de la carga, brindando de este modo protección y reconocimiento a la empresa.

En ese sentido, el velar por la seguridad en la cadena de suministro es una estrategia vital y efectiva para identificar y corregir errores de manera eficaz, evitando riesgos e incluso la configuración de un delito (tráfico de armas, contaminación de mercancías, contrabando, introducción de armas). Aunado a lo anterior, la empresa obtendrá prestigio, reconocimiento, reducción en costos y tiempos de despacho de la mercancía, entre otros beneficios aduaneros.

Inscripción en el Padrón de Importadores (sectores específicos)

Para las empresas que quieran importar mercancías a México existe la obligación de inscribirse en el Padrón de Importadores y en el caso de las fracciones arancelarias listadas en el apartado A del Anexo 10 de las Reglas Generales de comercio exterior (textiles, armas, automotriz, etc.) inscribirse en el Padrón de Importadores de Sectores Específicos.

VTZ te asesorará para cumplir con todos los requisitos de inscripción y lograr obtener exitosamente dicho registro, facilitando de este modo todas tus operaciones de comercio exterior y en total apego a la legislación nacional.

Efectos fiscales de operaciones de comercio exterior y Certificación de IVA/IEPS

Al entender completamente la compleja relación entre el comercio internacional y lo fiscal, tenemos la capacidad para revisar e identificar aquellas operaciones aduaneras con efectos jurídico-fiscales. VTZ asesora empresas en la implementación y operación de prácticas preventivas y correctivas con el fin de que cumplan con sus obligaciones fiscales, así como utilizar beneficios fiscales y aduaneros, logrando de esta manera mejorar su posición competitiva y la estabilidad de su negocio.

Certificación de IVA/IEPS

Evitar el pago del IVA y IEPS al importar es esencial para mantener liquidez y, particularmente, una posición competitiva. Por consiguiente, nosotros asesoramos a empresas para lograr la certificación en materia de IVA y IEPS, y verificamos el cumplimiento permanente de los requisitos para mantener o renovar dicha certificación.

- Obtención y cumplimiento del programa IMMEX

- Seguridad en la cadena de suministro y certificación

- Inscripción en el padrón de importadores

- Efectos fiscales y certificación IVA/IEPS

Obtención y cumplimiento del programa IMMEX

Ayudamos a empresas que se dedican a la elaboración, transformación y reparación de productos, así como la prestación de servicios a la exportación, para que obtengan y, posteriormente, cumplan con el programa IMMEX. Para lo anterior, resultan necesarios una serie de programas, permisos y registros para cumplir con la legislación mexicana y ser una empresa competitiva en sus costos.

En VTZ contamos con una gran experiencia en el apoyo y asesoramiento a la industria maquiladora y manufacturera. Nuestro equipo analizará e identificará la estrategia adecuada para planear e implementar lo necesario para la obtención de los programas de fomento de la industria maquiladora y manufacturera. De igual manera, brindará la asesoría necesaria para mantener, ampliar o renovar el programa según sea el caso.

Seguridad en la cadena de suministro y certificación OEA

Nuestro equipo puede ayudarle a fortalecer la seguridad de la cadena de suministro de comercio exterior de tu empresa. Lo anterior, a través de la implementación de estándares mínimos en materia de seguridad internacionalmente conocidos, con la finalidad de obtener la certificación de Operador Económico Autorizado.

Nuestra asesoría consiste en el desarrollo y acompañamiento de estrategias para mejorar la seguridad de la cadena de suministro, con el objetivo de obtener la certificación y principalmente evitar la contaminación de la carga, brindando de este modo protección y reconocimiento a la empresa.

En ese sentido, el velar por la seguridad en la cadena de suministro es una estrategia vital y efectiva para identificar y corregir errores de manera eficaz, evitando riesgos e incluso la configuración de un delito (tráfico de armas, contaminación de mercancías, contrabando, introducción de armas). Aunado a lo anterior, la empresa obtendrá prestigio, reconocimiento, reducción en costos y tiempos de despacho de la mercancía, entre otros beneficios aduaneros.

Inscripción en el Padrón de Importadores (sectores específicos)

Para las empresas que quieran importar mercancías a México existe la obligación de inscribirse en el Padrón de Importadores y en el caso de las fracciones arancelarias listadas en el apartado A del Anexo 10 de las Reglas Generales de comercio exterior (textiles, armas, automotriz, etc.) inscribirse en el Padrón de Importadores de Sectores Específicos.

VTZ te asesorará para cumplir con todos los requisitos de inscripción y lograr obtener exitosamente dicho registro, facilitando de este modo todas tus operaciones de comercio exterior y en total apego a la legislación nacional.

Efectos fiscales de operaciones de comercio exterior y Certificación de IVA/IEPS

Al entender completamente la compleja relación entre el comercio internacional y lo fiscal, tenemos la capacidad para revisar e identificar aquellas operaciones aduaneras con efectos jurídico-fiscales. VTZ asesora empresas en la implementación y operación de prácticas preventivas y correctivas con el fin de que cumplan con sus obligaciones fiscales, así como utilizar beneficios fiscales y aduaneros, logrando de esta manera mejorar su posición competitiva y la estabilidad de su negocio.

Certificación de IVA/IEPS

Evitar el pago del IVA y IEPS al importar es esencial para mantener liquidez y, particularmente, una posición competitiva. Por consiguiente, nosotros asesoramos a empresas para lograr la certificación en materia de IVA y IEPS, y verificamos el cumplimiento permanente de los requisitos para mantener o renovar dicha certificación.

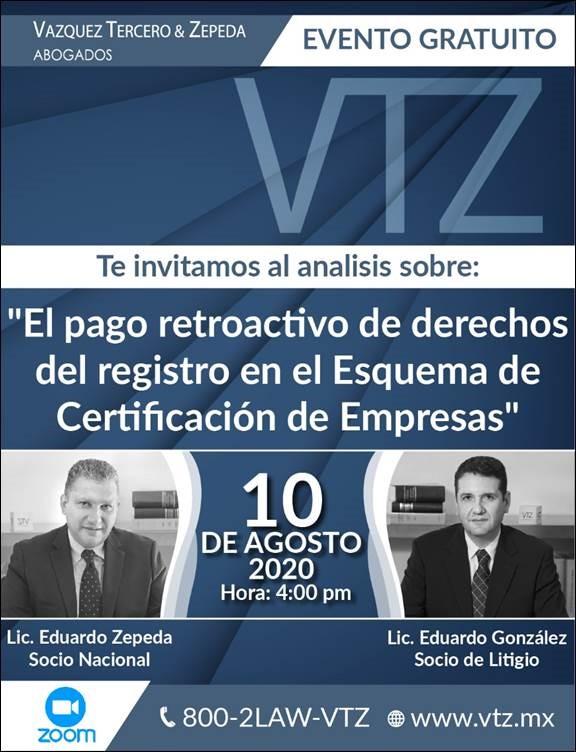

Nuestras Guías y Publicaciones sobre IMMEX

Noticias Recientes IMMEX

Miembros Claves

¿Por qué escoger VTZ?

Conocemos la industria IMMEX al derecho y al revés, y siempre empujamos sus límites en favor de nuestros clientes. Gracias a nuestra especialización y la manera en que atendemos a nuestros clientes, VTZ abogados ha recibido numerosos reconocimientos:

La especialización de nuestra firma y sus miembros nos permite entender la complejidad del panorama regulatorio para las operaciones de comercio internacional, guiando a nuestros clientes y sus negocios.

Miembros de INDEX Nacional

VTZ abogados es un afiliado estratégico de INDEX National, una asociación que agrupa los intereses de la industria IMMEX. Nuestros miembros claves participan activamente en comités y proyectos y, por tanto, estamos constantemente actualizados al tanto de problemas que la industria IMMEX se enfrenta en sus operaciones, así como involucrados en el desarrollo de cambios regulatorios.

Contacta a los Expertos en IMMEX

Por favor llena el formulario con tu mensaje y alguien de nuestro equipo se pondrá en contacto contigo.