Our first chapter of Doing Business in Mexico, Why Invest in Mexico?, will serve as an introduction providing a general overview of the current economic and business environment.

VTZ Law Firm analyzes Mexico’s doing business rankings and economic indicators –positive and negative– from the World Bank and the World Economic Forum.

Also, we summarize trade and foreign direct investment statistics with a strong focus on the manufacturing industry, land in Mexico for industrial purposes, and security considerations.

- Mexico in Competitiveness Rankings

- Trade and Investment in the Manufacturing Sector

- Land in Mexico for Industrial and/or Manufacturing purposes

- Security Considerations

- Mexico in Brief

1. Mexico in Competitiveness Rankings

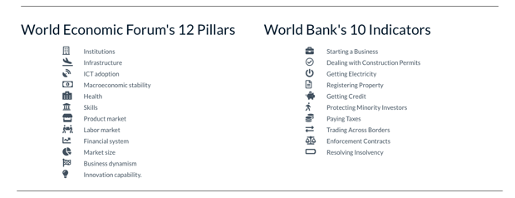

Although Mexico is not one of the most competitive countries in the world, Mexico is the second Latin American most competitive economy according to the World Economic Forum (WEF) and the World Bank (WB). WEF’s Global Competitiveness Index 2019, a yardstick for policymakers, analyzes 12 “broad” pillars that shape an economy of a country. Meanwhile, the WB’s Doing Business gathers information regarding the regulatory environment and how it impacts in local firms, reporting 10 key indicators.

1.1 Positive Economic and Business Indicators in 2019

WEF’s Global Competitiveness Index 2019

Mexico stands out in macroeconomic stability (41st) and market size (11th) pillars, which are very relevant indicators to invest or do business in Mexico. This is no surprise as Mexico’s inflation has been controlled, around 3% to 4% per year; its GDP has had a stable growth, about 3%, in the last decades; and, its public debt has been properly managed.

Needless to say, inflation has had few spikes, notably in 2017, as a result of the liberalization of energy goods; and, despite having the second largest market of Latin America (124 million people), Mexico has a low GDP per capita or purchasing power.

Furthermore, Mexico also stands out in the following specific indicators: budget transparency (6th), energy efficiency regulation (30th), renewable energy regulation (30th), road connectivity (22nd), airport connectivity (15th), liner shipping connectivity (34th), electricity access (% of population) (2nd), debt dynamics (36), trade openness (27), ease of hiring foreign labor (48), financial stability (30), cluster development (36), among others.

WB’s Doing Business 2020

Mexico is ranked in 60th place overall, out of 190 economies, and is one of the top business-friendly environments in Latin America, only behind Chile that ranks in the 59th position. Mexico’s top three topics or indicators are getting credit (11th), resolving insolvency (33), and contract enforcement (43rd).

As a result of strong legal rights in relation to collateral laws (securities) as well as a robust credit reporting system, Mexico outperforms most economies in getting credit. Mexico also has a decent performance in the resolving insolvency and contract enforcement indicators, particularly, due to time to carry out a dispute in a court (under certain assumptions) and strength of insolvency framework index.

1.2 Negative Economic and Business Indicators in 2019

WEF’s Global Competitiveness Index 2019

Unsurprisingly, Mexico underperforms in the Institution and Labor Market pillars of the WEF’s Global Competitiveness Index 2019. Although serious legislative steps have been made on security, corruption, and “regulatory improvement”, Mexico continues to rank particularly low in a handful of matters that fall under the Institution pillar such as security (138th), burden of government regulation (116th), judicial efficiency (116th), judicial independence (103rd), as well as incidence to corruption (116th).

Insecurity is a concern not only for foreign investors. We note that the new administration has pushed for constitutional and legal reforms that have overhauled security bodies, the attorney general’s office, and powers to the Tax Authority (SAT, acronym in Spanish) against tax evasion schemes. The Financial Intelligence Unit (UIF, acronym in Spanish) has been tackling high profile individuals and companies that are allegedly involved in laundering money or in corrupt practices.

As for the Labor Market pillar, Mexico underperforms in redundancy costs (e.g. severance of labor contracts) (103rd), as well as labour tax rates (116). Needless to say, Mexican Labor Law has undergone a significant overhaul as a result of USMCA’s Labor Chapter, which seeks to protect collective labor rights. However, neither redundancy costs nor labor tax rates (i.e. a state tax) were addressed in such reform.

WB’s Doing Business 2020

Known to have a complicated tax environment, Mexico is ranked in the 120th position out of 190 economies in the Paying Taxes topic of WB’s Doing Business 2020. Under normal circumstances, a company would have to pay six taxes throughout the year, namely corporate income tax, value-added tax, security social contributions, payroll tax, property tax*, and vehicle tax*.

Despite a low number of tax payments as compared to other jurisdictions, Mexico’s tax environment is poorly ranked especially due to (1) total tax and contribution rate and (2) the post-filing index. For instance, Mexico’s statutory tax rates for the corporate income and VAT, which are the most time consuming and prone to tax audits, are set at 30% and 16% respectively. Furthermore, VAT refunds or income tax corrections take a considerable amount of time and effort.

Mexico’s also underperforms in Starting a Business (107th). Though starting a business is discussed in the Chapter – Creating a Company in Mexico, the process to incorporate a company appears, in its face, straightforward in Mexico. According to the guide, a non-foreign entrepreneur has to complete eight procedures to incorporate a company and to have all registrations in order; however, a significant practical hurdle is that concerning to the company’s registration before SAT.

Likewise, the number of procedures and time are factors that negatively affect Mexico’s score in Getting Electricity (106th), meanwhile the number of procedures, cost, among other matters, influence Mexico’s negative performance in Registering Property (105th).

2. Trade and Investment in the Manufacturing Sector

Mexico’s foreign direct investment (FDI) and international trade are, to a great extent, attributable to the established manufacturing sector, which convinces foreign investors to invest in Mexico. According to UNCTAD’s World Investment Report 2020, Mexico is the 14th country with most FDI inflows in the world in 2019. In sum, Mexico is a top FDI destination.

As noted by the WEF, Mexico has a strong cluster development. This feature explains why almost half of Mexico’s FDI inflows are related to the manufacturing sector.

Investment Inflows in the Mexican Manufacturing Sector

The top five manufacturing sub-sectors that have attracted investment from 1999 to 2019 are (1) transport equipment (e.g. auto), (2) beverages and tobacco, (3) chemical, (4) computer, communication, and measurement equipment, and (5) the food industry.

For instance, FDI in the transport equipment (or auto sector) has amounted to 79,053 million USD since 1999, which represents 21% of Mexico’s total foreign direct investment inflows as noted in the table below:

Mexico has different levels of industrialization. In fact, most of the manufacturing sector has established itself in the north and the center of the country. For instance, the (passenger) auto industry and the OEM (Original Equipment Manufacturers) are located in the States as indicated in the image below.

International Trade and Manufactured Goods

Establishing itself as an important manufacturing hub, Mexico is an economy with a significant presence in international trade. Mexico ranks in 12th place among world economies in both exports and imports, its trade balance amounts to 916 billion USD in 2019. The World Trade Organization describes Mexico as:

“a ‘buyer’ in GVCs and therefore has a significant rate of GVC backward participation, standing at 36 percent in 2015. The economy imports inputs mostly from the United States and China to produce its exports.”[1]

Mexico’s main exports include (1) manufactured goods, (2) fuels and mining products, (3) agricultural products that amount a total of 461 billion USD.

Mexico’s Export Destination in 2019

In 2019, Mexico exported 461 billion USD. Unsurprisingly, Mexico’s main export destination is USA exports amounting to $371 billion USD, followed by the European Union $24 billion USD, Canada $14 billion USD, and China $7 billion USD%.

Mexico’s Origin of Imports in 2019

As for import data, US imports amount to 205.733 billion USD, China 83.052 billion USD, European Union imports amount to 51.237 billion USD, Japan 17.963 billion USD, and Korea 17.649 billion USD

Comparing the US-China trade relations, US exports more goods in value to Mexico than to China. For instance, US exports to China amounted to $106 billion in 2019.

Land in Mexico for Industrial and/or Manufacturing purposes.

Land in Mexico may be purchased or leased for industrial purposes. Needless to say, Mexican law has restrictions as to the ownership of land when, for instance, it is located in the northern border strip or near the coastline (see our Foreign Investment Chapter)…..

To continue reading our Guide, please fill out the form below.

For more information about VTZ Law Firm services, visit our website or contact us info[@]vtz.mx!

Security Considerations: Does it Affect Decisions to Invest in Mexico?

Mexico limps from security-related matters that affect its competitiveness indicators significantly, which may affect decisions to invest in Mexico. We cannot turn a blind eye on this fact, and foreign investors normally pose the question:

How risky is Mexico?

The American Chamber of Commerce in Mexico (Amcham), which we are members, published…

To continue reading our Guide, please fill out the form below.

For more information about VTZ Law Firm services, visit our website or contact us info[@]vtz.mx!

Cargando…

Cargando…

[1] World Trade Organization, World Trade Statistical Review 2019, pg. 43